Trading kitne Parkar ke hote hai

Trading ka matlab hai kisi cheez ko khareedna aur bechna, jaise stocks, commodities, currencies, ya kisi aur asset ko. Yeh ek financial activity hai jisme log market me price changes ka faida uthate hain.

Trading ka do main types hote hain:

Stock Trading: Isme log company ke shares (stocks) khareedte aur bechte hain. Yeh stock market jaise platforms par hota hai, jaise NSE, BSE, NYSE, etc.

Forex Trading: Isme log ek currency ko doosri currency ke against trade karte hain, jaise USD/INR, EUR/USD, etc.

Trading me, investors market ki movement ko predict karte hain aur jab price unki expectation ke according badalta hai, toh wo profit kama lete hain. Lekin, yeh high risk bhi hota hai, kyunki price kabhi bhi reverse ho sakta hai.

Trading ke kai prakar hote hain, jo alag-alag time frames aur strategies par adharit hote hain. Yahan kuch pramukh prakar diye gaye hain:

Day Trading:

Isme trader ek hi din ke andar shares ya assets ko khareedte aur bechte hain. Day traders ka goal hota hai price movement ka short-term fayda uthana. Yeh high risk aur high reward strategy hoti hai.

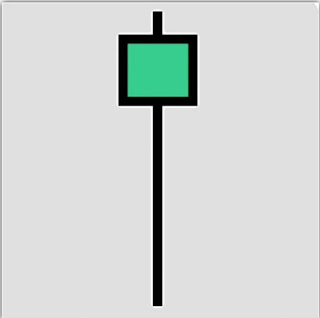

Swing Trading:

Swing traders short-term price movements ko capture karte hain, par yeh trades kuch din se lekar kuch hafton tak chal sakte hain. Swing traders market ki short-term swings ko identify karke profit kamane ki koshish karte hain.

Scalping:

Scalping ek bahut hi short-term trading style hai, jisme traders kuch seconds ya minutes ke andar market mein small price movements se profit kamaane ki koshish karte hain. Isme bohot tezi se decisions lene padte hain.

Position Trading:

Position trading long-term trading ka ek form hai, jisme traders long periods (months ya years) ke liye kisi asset ko hold karte hain. Yeh strategy fundamental analysis par adharit hoti hai, jisme traders kisi asset ke long-term growth potential par focus karte hain.

Trend Following:

Isme traders market ke trend ko follow karte hain, chahe woh upward ho ya downward. Agar market bullish hai, toh trader buy positions leta hai, aur agar market bearish hai, toh sell positions leta hai.

Algorithmic Trading:

Yeh ek automated trading hai jisme pre-programmed algorithms (computers) market conditions ke hisaab se trades execute karte hain. Isme human emotions ka koi role nahi hota aur trades bahut jaldi execute hote hain.

Options Trading:

Options trading mein traders options contracts (call aur put options) ko buy aur sell karte hain. Yeh derivative instruments hote hain, jo ek underlying asset ke price movement se judi hoti hain.

Futures Trading:

Futures trading mein traders ek contract ke through kisi asset ko future mein ek predetermined price par buy ya sell karne ka agreement karte hain. Yeh bhi ek derivative instrument hai aur zyada leverage ka use kiya jaata hai.

Forex Trading:

Forex trading mein currencies ke pairs ko buy aur sell kiya jata hai. Jaise USD/INR, EUR/USD, etc. Yeh global market mein hota hai aur 24 hours open rehta hai.

Comments

Post a Comment